ICHRA + Cafeteria Plan for tax advantages

Both employers and employees benefit by paying lower taxes to help keep health care costs more affordable. In some instances, the savings can be significant.

Putting more money into employee paychecks by reducing the cost of healthcare is important to all employers. The good news is that there are more ways to do this than ever before. Learning the options to maximize employee paychecks and reduce employer taxes is a win-win for everyone.

What are ICHRAs and QSEHRAs

ICHRA (Individual Contribution Health Reimbursement Arrangement) and QSEHRA (Qualified Small Employer Health Reimbursement Arrangement) are two HRA types that enable employers to reimburse employees for individual health insurance, marking a form of employer-sponsored health coverage.

The differences between the two HRAs are:

- Company Employee Size: Determines eligibility.

- Desired Contribution Sizes: Influences funding levels.

- Flexibility for Job Classes and Reimbursements: Varies between the two, affecting customization of benefits.

These reimbursements through the HRA create tax advantages. They are deductible for the employer and income tax free to the employee. Both are game changers for employers, allowing them to set a budget per employee per month and thereby reimburse employees for the choices they make for individual or family health insurance, dental insurance, vision insurance, and other qualified medical expenses.

Section 125 of the Internal Revenue Code, known as a “Cafeteria Plan,” permits pre-tax payment of certain expenses by employees. This includes insurance premiums and medical or dependent care costs, effectively reducing their gross income. This in turn reduces an employee’s State, Federal and FICA (Social Security and Medicare) taxes. Lower gross income also allows the employer to pay a lower amount of matching FICA taxes. Cafeteria Plans have traditionally been used to allow group health insurance premiums, both employer paid and employee paid, to be paid pre-tax.

“An HRA combined with a section 125 Cafeteria Plan provides maximum tax advantages.”

More employers are moving away from traditional group health insurance to ICHRA or QSEHRA models. Utilizing all tax advantages in this shift is crucial but sometimes overlooked. An employer can do a stand-alone HRA, but an HRA combined with a Section 125 Cafeteria Plan provides maximum tax advantages.

Adopters of HRA’s are falling into two camps. First there are companies who have long offered employee benefits in the group market and are changing their model. New HRA adopters include employers now providing benefits to all full-time employees. They’re also expanding benefits to classes like part-timers, traditionally ineligible. First-time benefit employers may lack knowledge on utilizing Section 125 plans to reduce taxes from insurance premiums and approved expenses. This can lead to missing out on potential tax savings for both themselves and their employees.

When individual insurance premiums exceed the amount of the employer contribution, an employee whose employer has a Cafeteria Plan can submit the remainder of the insurance premium for pre-tax deductions to gross income.

“…an employee whose employer has a Cafeteria Plan can submit the remainder of the insurance premium for pre-tax deductions.”

This results in substantial additional tax savings to both the employer and the employee.

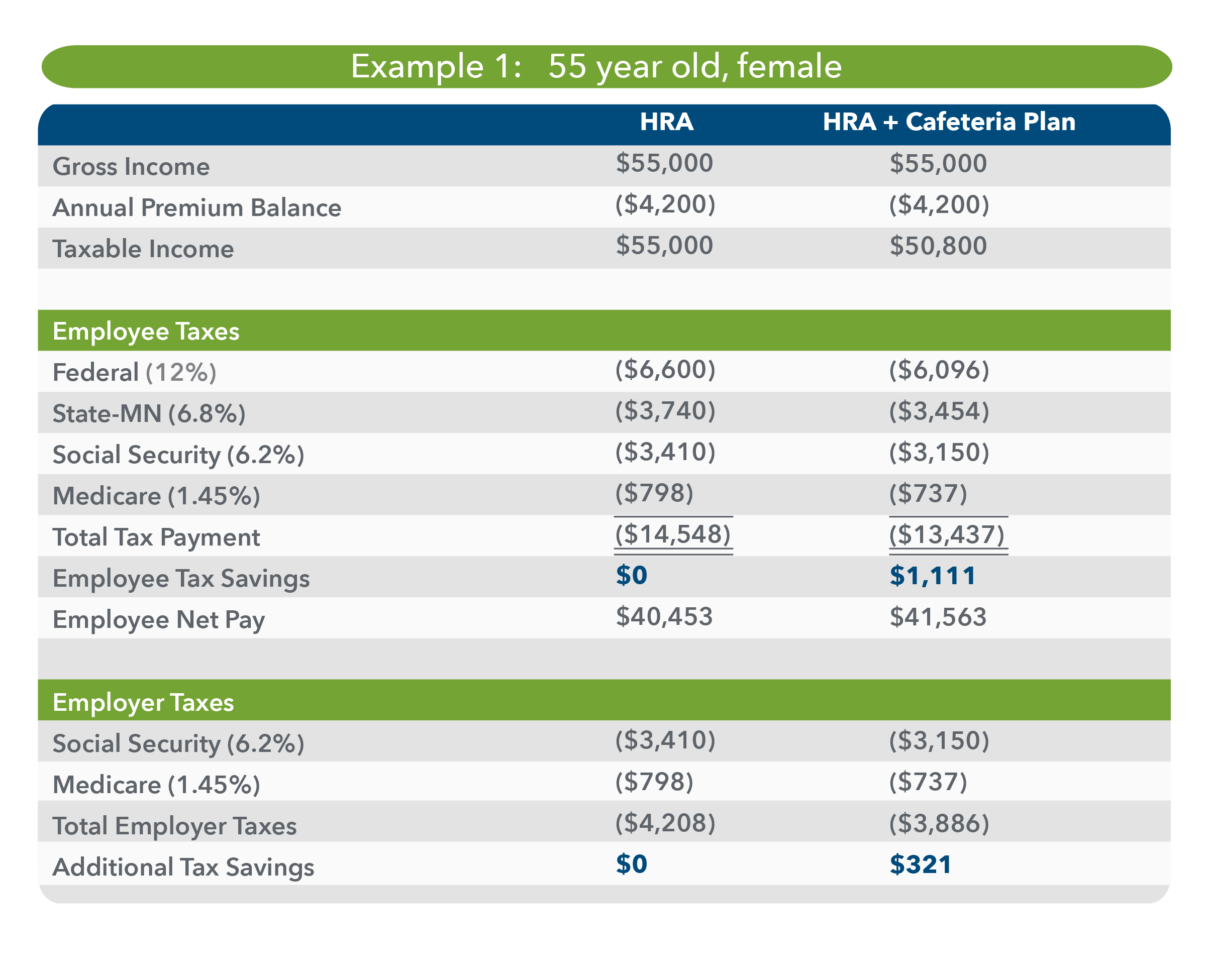

Let’s look at an example.

A single female employee aged 50 in Minnesota with a $55,000 annual salary has a $250 monthly employer contribution towards her insurance through an HRA. In her case, she decides on a benefit-rich “gold” health insurance plan, along with a dental and vision insurance plan. Her combined monthly premium is $600 a month, significantly more than the $250 employer contribution. Therefore, because her employer allows for Section 125 Cafeteria Plan deductions, the extra $350 in premium she pays every month above the employer reimbursement can be deducted directly from her gross income, for a lower taxable income. The result is the employee pays $1,401 a year less in taxes, and the employer also pays $321 a year less in payroll taxes.

When insurance premiums are too high

When insurance premiums are too high

Employees can use employer-funded ICHRA’s or QSEHRA’s to be reimbursed for individual health insurance, dental insurance, vision insurance and other qualified medical expenses. Through these HRA’s, employers set an allowance to reimburse employees on a monthly basis. Should the employer reimbursement amount be less than an employee’s total premium, the unreimbursed amount of the premium can be reported through a Section 125 plan for a lower tax amount and higher take home income.

The logistics of recording this Section 125 plan can vary from company to company. One method is it can be documented by your ICHRA or QSEHRA administrator and reported to the employer. Then the employer can record it on their payroll as a non-cash deduction for a Section 125 expense. This will lower the employee’s taxable income, without lowering their paycheck.

New models for health care financing will continue to evolve, and the guidelines to embrace these new models will continue to be adopted by employers wanting to maximize health care premium value for themselves and for their employees.

Written by Margaret Lett, PhD.

Dr. Lett has 15 years experience in healthcare financing. She has a PhD in Economics and currently resides in Minneapolis, Minnesota.’

Click here to download the full article and enjoy offline

Ready to Discuss Your Options? Contact Benafica

At Benafica, it’s our mission to educate companies and individuals on the healthcare benefits available to them, so they can make the coverage decisions that best meet their needs. If you’re ready to learn more about your business’s health benefits options, feel free to give our team a call today at 651-287-3253 or send us a message, and we’ll be in touch promptly.