End-of-year tax and compliance requirements are especially important when you offer an ICHRA. Staying on top of which forms to file, what notices to send, and key deadlines to review ensures you remain compliant and prepared in case of an audit. Working with Benafica takes the guesswork out of the process. We’ve included our ICHRA Employee Benefits Compliance Checklist in this blog post to help you systematically review every required item, so you can have confidence that everything is under control.

Reimbursement & Contribution Reconciliation

End-of-year reimbursement and contribution reconciliation is all about making sure the numbers add up. Review each employee’s annual ICHRA totals and confirm they align with your payroll records, including any portion employees may have paid toward uncovered premiums. Keeping receipts and documentation is essential for compliance and audit readiness.

BONUS: If your plan is administered through Benafica, all of this is tracked automatically in BEN360, with receipts attached, and you can easily download monthly or annual Excel charts or schedule recurring reports to streamline reconciliation.

ICHRA Forms Tax Filing Deadlines

First thing’s first, the forms you actually have to file. This includes Forms 1095-B and 1095-C (plus their transmittals 1094-B/C), the PCORI fee, Form 5500 if your ICHRA is part of a broader ERISA plan, and the Medicare Part D Creditable Coverage Notice.

| Form | What is it? | 2026 Deadline |

| 1095-B | Reports minimum essential coverage (MEC) provided to employees through an ICHRA or other health plan | Mar 2 (for 2025 reporting;; typically Feb 28th for paper or Mar 31 for electronic filing) |

| 1095-C | Provided by Applicable Large Employers (ALEs) to report offers of health coverage under the ACA | Mar 2 (for 2025 reporting; same rules as 1095-B) |

| 1094-B/C | Transmittal forms submitted to the IRS along with 1095-B/C forms | Mar 2 (for 2025 reporting; same rules as 1095-B) |

| W-2 Reporting (Box 12, code DD) | Shows the cost of employer-sponsored health coverage for informational purposes (does not affect tax liability.) ICHRA amounts are not included in this box if only used for premiums. | Jan 31 (to employees) |

| 720 (PCORI fee) | A federal fee assessed on self-insured health plans to fund the Patient-Centered Outcomes Research Institute | Jul 31 (calendar-year plans) |

| 5500 (if applicable) | Annual ERISA reporting for welfare benefit plans | Jul 31 (calendar-year plans) |

| Medicare Part D Creditable Coverage Notice | Required notice to employees eligible for Medicare | Oct 15 (before Medicare OE) |

| Section 111 MSP Report | Report to CMS on group health plan eligibility for Medicare-eligible individuals | Quarterly |

Annual Review Items

Before the year wraps up, it’s important to take a closer look at your ICHRA’s plan documentation and structure.

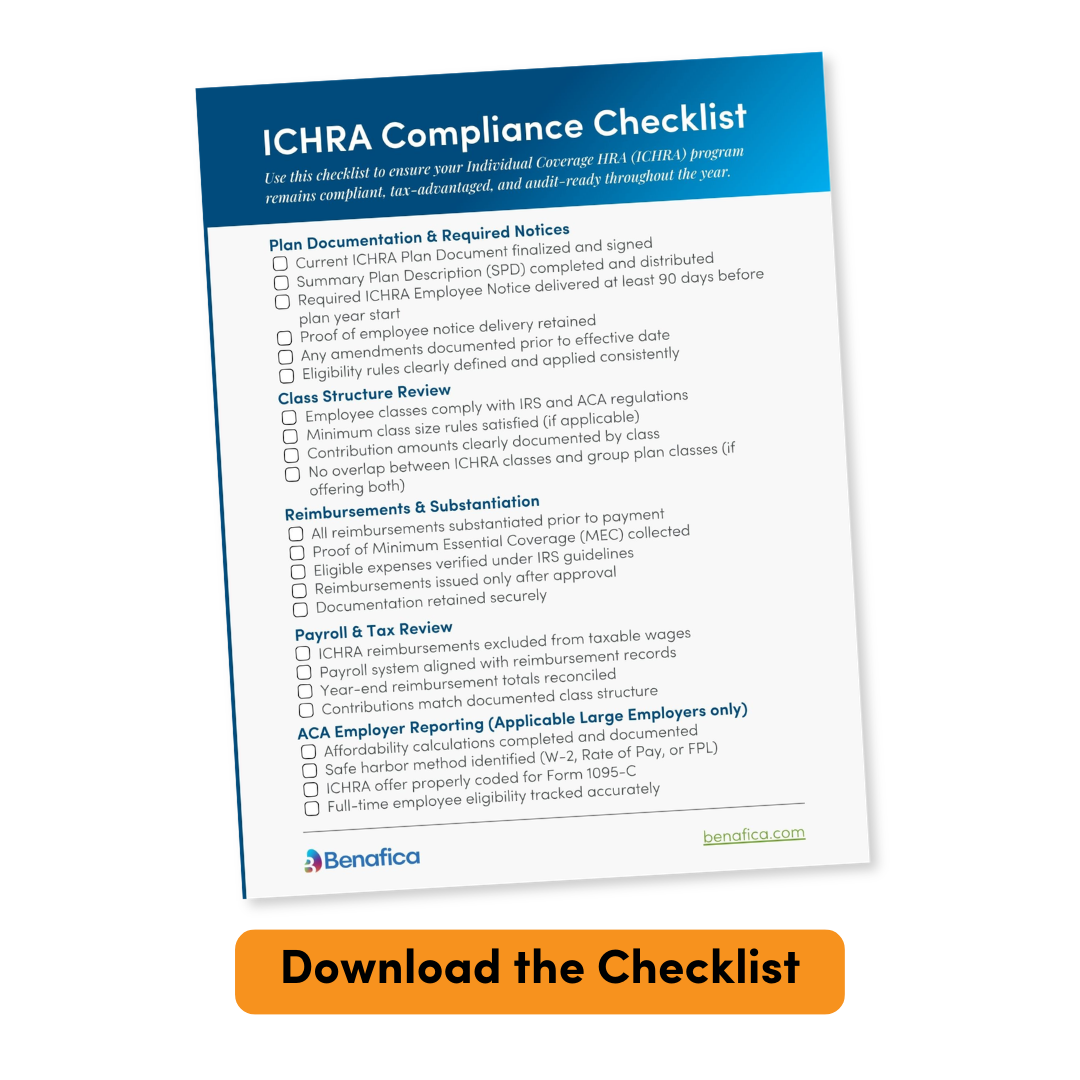

Our end-of-year ICHRA compliance checklist helps you make sure you’re covered in the following areas:

- Plan Documentation & Required Notices

- Class Structure Review

- Ongoing Reimbursements & Substantiation

- Payroll & Tax Review

- ACA Employer Reporting for ALEs

- Throughout the Year Watchlist